Syd HanniganGrocer at heart with 30 years in the business. Co-founder at Pivotal Tools. Independent grocers often rely on manual data collection and analysis, like movement reports, which can make it difficult and time consuming to identify opportunities for sales growth or changing consumer trends. A key to addressing sales opportunities is to quickly identify areas where valuable attention is required to maximize sales and customer satisfaction. For example, as an Independent Grocer, I’m sure you’ll want to identify areas that are underperforming. The easiest way to do that is to evaluate changes in same store sales for key departments and categories, and even top items. Looking at changes in same store sales tells a story, both when comparing to previous periods, but also when comparing stores in multi-store chains. If sales growth is declining and customer count is up or stable, it could indicate that customer preferences are changing and hence customer baskets are changing. This is important to know. If you see Price per Item declining in a category (or department), it could very well indicate customers are increasingly price sensitive and are showing a preference for lower cost items in the category. So here are a couple of examples: If we look at Cabernet Sauvignon, a key wine category, we might see the following trends in the performance indicators. This combination of indicators indicates a potential change in consumer preferences, or potentially Out of Stocks in certain items, resulting in smaller baskets with lower priced items. Looking at the performance of top items in the category will likely tell you where the issue (and the opportunity) is! Further, if we look at the Cabernet Sauvignon category sales across multiple stores, this will help identify execution issues. In the example below, we see Cabernet sales up (compared to last year) in 2 stores, but not in the 3rd, now we know immediately where to focus our efforts. These are just a couple of examples where a busy store manager or category manager can use key indicators to quickly identify where to focus valuable time to deliver the biggest impact.

Key to this effort is access to key metrics and then the ability to “drill down” into the issue (department, category, item) to determine cause. It will also be important to monitor these indicators after action is taken to evaluate impact and results. To show you how this might work, click on the button below for a quick video (<3 min) that shows how easy it is to identify these types of opportunities.

0 Comments

Brad ZengerPivotal Tools Marketing Guy who loves food and wants to see Independent Grocers Win! For Pivotal Tools Grocers, Labor Day 2021 was strong, with same store sales up 9% over the most recent "normal" year of 2019, and down only slightly (-1%) relative to the exceptional pandemic Labor Day of 2020.

Elevated Labor Day sales were driven by an average basket up over 34% compared to 2019, while customer trips are down 19%, but up 3% relative to 2020. Customers are clearly returning to their local grocers more frequently while continuing to buy at historically elevated levels. Why is this important? At Pivotal Tools, we are working to empower Independent Grocers to serve their shoppers even more effectively in an increasingly competitive retail environment. We provide Independent Grocers actionable insights, in their pocket, about their business and shoppers that results in sales growth. As an example, Grocer Top 10 Sales Items continue to tell an evolving story of shopper behaviors they continue to navigate the current pandemic influenced landscape. Produce and Meat Items together represent over half of the Top 10 items across our Customers' stores for this Labor Day weekend. Deli/Prepared Food items represented 3 of the Top 10 for Labor Day 2019, but fewer than 2 in 2020, and just over 2 in 2021, reinforcing the ongoing trend of significant growth/recovery in prepared foods. The biggest Top 10 loser is liquor (including beer and wine) which fell out of the Top 10 in 2021, compared to a Liquor Comforted 2020! That certainly tells a story about how shoppers needed less liquor to navigate this Labor Day compared to the last one! We continue to be excited for our Grocers, who are delivering for their customers with continued elevated basket sizes and strong growth in deli/prepared foods sales! Brad ZengerPivotal Tools Marketing Guy who loves food and wants to see Independent Grocers Win! Our Q2 survey of selected Independent Grocer Customers shows some interesting trends:

So the question remains, what's the new normal? Will customer trips and basket size return to historical norms as represented by 2019? What is clear is that shoppers are showing an increasing preference, or more appropriately a return to their previous preferences, for foods prepared by their local Independent Grocer. Service Deli and Bakery departments are showing significant increases relative to 2020, up 44% and 11% respectively. Service Deli/Prepared Foods remains significantly below 2019 levels both in absolute Sales ($'s) as well as share of basket; indicating significant sales increases in these key categories in the months to come. Another key indicator, Top Items, reinforces this opportunity: Prepared Food items represented nearly 5 out of their Top 10 items at the store level of our surveyed Grocers. In 2020, there was only 1 Service Deli/Prepared Food item in their Top 10. Now in Q2 '21, there were still only 2 Prepared Food items in the Top 10. Selected Statistics 2019 2020 2021 Q2 Sales/Week/Store $650,000 $727,000 $675,000 Q2 Basket $32 $58 $45 Service Deli Weekly Sales $110,000 $68,000 $94,000 Service Deli Items in Store Top 10 5/10 1/10 2/10 Service Deli Share of Basket 17% 9% 14% All of this points to an incredible opportunity for Independent Grocers to maintain those elevated baskets, provoked by the pandemic. One way to do that clearly is by offering even more creative, compelling prepared foods offerings that entice customers to stay at their local Independent Grocer for those meals they don't want to prepare themselves! Brad ZengerPivotal Tools Marketing Guy who loves food and wants to see Independent Grocers Win! In our ongoing effort to provide Independent Retailers Powerful Perspectives and Actionable Insights, we looked at a collection of our customers, Independent Grocers across the country, to understand what Memorial Day weekend* sales could tell us about consumer behavior and the opportunity for Independent Grocers.

Memorial Day 2021 was significantly different than 2020 and even 2019. While same store sales were down relative to 2020, when everybody was locked down, they were up significantly compared to 2019. Memorial Day Weekend Sales: 2019 2020 2021 Weekly Sales**: $452,000 $539,000 $510,000 Same Store Sales - 19% -5% Same Store Sales (Compared to 2019): - 19% 13% Store sales only tells part of the story! For the rest of the story, we need to look at the basket. Memorial Day Weekend Basket: 2019 2020 2021 Basket: $35.55 $58.60 $50.39 Change in Basket (vs Previous Year): - 65% -14% Change in Basket (Compared to 2019): - 65% 42% The basket for our Independent Grocers, remains at significantly elevated level, up 42% at $50.3,9 relative to 2019. The composition of the basket, yields even more interesting insights! Memorial Day Weekend 2019 2020 2021 Basket Composition (by Dept) Grocery 32% 34% 32% Produce 17% 18% 19% Meat 17% 18% 18% Service Deli/Prepared Foods 15% 10% 13% Service Bakery 5% 4% 5% General Merchandise 4% 4% 3% Liquor 10% 11% 11% Service Deli/Prepared Foods 2019 2020 2021 Weekly Sales $106,900 $84,100 $99,800 Same Store Sales -- -21% 19% Same Store Sales (Compared to 2019): -- -21% -6% This data suggests that shoppers are definitely coming back to buy prepared foods/service deli items, and not just on Memorial Day. There's more deli prepared foods sales to come. To get back just to 2019 sales levels for service deli/prepared foods predicts an increase of more than 6% in the near future. If customer basket size continues at current levels the increase in service/deli sales will be even greater! Definitely keep an eye on that basket size! We'll be back with more data indicating those increases in service deli sales will happen quickly! *Memorial Day weekend includes sales for Friday - Monday of the Memorial Holiday for 2019, 2020, and 2021. ** Memorial Weekend Sales are normalized to a week period to allow comparison to other periods Pivotal Perspectives 0521-01 BRAD ZENGERPivotal Tools Marketing Guy who loves food and wants to see Independent Grocers win! Key IndicatorsTo help provide some perspective for Independent Grocers as we emerge from the Covid-19 pandemic, we thought it would be useful to see the performance of other Independent Grocers as they navigate this interesting period. We surveyed a collection of our customers. Below are some key indicators for these retailers as they navigate this period.

As a reminder, significant lockdowns/stay at home mandates started the 2nd week of March 2020. This resulted in significant increase in store sales in March 2020 relative to the same period in 2019 - many up over 50% and this period now forms the basis for same store comparisons in 2021. Below you see the comparison of 2021 monthly same store performance compared to the same period in 2020. Note that 2021 weekly sales are not changing significantly from month to month this year, yet the comparisons to 2020 vary significantly, clearly reflecting the dramatic change in shopper behavior during the comparison period in 2020. You will also see similar same store comparisons for key departments. As we start to return more "normal" shopper behavior, note the significant growth, in the prepared foods categories: Service Deli and Bakery (See deli/prepared foods same store sales for April 2021). You can also see, in general over the last couple of months, customers shopping more frequently, with smaller baskets compared to 2020. Period Jan 2021 Feb 2021 March 2021 April 2021 Weekly Sales: $430,700 $444,200 $435,500 $444,300 Comparable Sales (vs 2020): `12.2% 13.5% -18.5% -9.4% Customers (vs 2020): -21.2% -20.4% -9.5% 28.4% Basket (vs 2020): 43.0% 43.3% -10.0% -28.9% Sales by Department (vs. 2020) Grocery 16.4% 15.7% -34.8% -22.9% Produce 17.4% 18.4% -15.1% -13.8% Deli/Prepared Foods -0.9% -12.6% 10.8% 97.9% Meat 30.9% 31.4% -25.2% -23.2% Liquor 29.1% 34.9% -1.8% -10.3% Bakery 2.6% 4.5% 3.7% 16.8% More updates and insights to follow in subsequent Blog Posts. Bradley A. ZengerPivotal Tools Marketing Guy who loves food and wants to see Independent Grocers win! Independent Grocers are experiencing significant competition from sophisticated, technology-empowered competitors. Chain retailers, highly targeted brick and mortar formats, as well as on-line grocery retailers are competing effectively for shoppers and shopping trips historically bound for Independent Grocers. Independent Grocers, with their preferred locations, experienced teams, and long established customer relationships have inherent advantages. However, they must respond effectively to gain market share as the market evolves. Successful Independent Grocers are leveraging their inherent strengths by empowering their most valuable asset, their team. New business intelligence tools, purpose built for Independent Grocers, can empower teams to deliver amazing results.

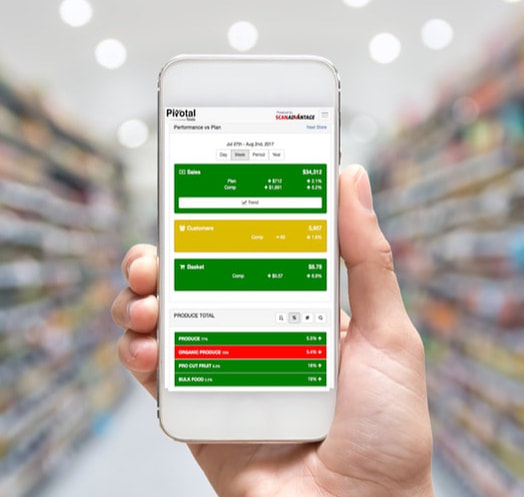

Pivotal Tools was formed to provide tools to Independent Grocers to help them compete more effectively in this increasingly competitive environment. PivotalView, from Pivotal Toos, is the emerging leader in this new category of tools. Prior to PivotalView, the common Business Intelligence tools used by grocers included back office systems and category analysis tools. These tools, accessible only through a desktop computer, typically present lots of data frequently in printed, static reports. Such reports are often difficult to understand and are not responsive to the demanding needs of fast moving, experienced merchants; merchants who are not analysts. These merchants don’t need data; they need Actionable Insights delivered by tools that are available wherever and whenever merchants need them. Actionable Insights, like those provided by PivotalView, are not presented in static reports. Actionable Insights is engaging, interactive, information generated through advanced analytics techniques, delivered in a way that is easy to understand, easy to implement and easy to evaluate. Actionable Insights deliver real results. For owners PivotalView is a solution that is extremelyaffordable, can be deployed easily and quickly without an IT team or traditional hardware or software resources. PivotalView allows merchants to really understand their business, respond to changing customer trends and ultimately deliver better results for customers. Teams using PivotalView start with key business metrics, like sales, customer count, and basket size delivered automatically to their smartphone or other mobile device (or desktop computers) every morning by 5:30 a.m. These business metrics are color coded, based on the retailer’s own targets; so that department managers, store managers, buyers, category managers as well as executives can easily prioritize efforts. With PivotalView if a department is underperforming, its indicators are red! Easy. You can then “drill down” to see which sub-departments or items are driving the underperformance. If categories are implemented, you can easily look at sales, customer count and even basket by category and then drill down to see which items are driving performance within those categories. If you want to evaluate a particular item or group of items; maybe items on ad, placed an endcap, or on a TPR, or some other promotion; there’s an easy search feature, using either the description or the UPC/PLU. It’s easy to find any item in the store. Then with just a click you can see a trend chart to quickly evaluate the effectiveness of any promotional effort for that item. Drill down to the item detail and you’ll see average selling price as well as item movement. Want to see a movement report for a department, category, a group of items, just one click – all on your smartphone. For multiple store chains, PivotalView allows members of each store team to easily see how their department, category, or item is performing compared to other stores in the chain. Making this information easily available unleashes healthy competition, highlights best practices, and can even identify store voids or out of stock situations. For chains with more centralized planning, there’s the ability to see chain level roll-ups of department and categories allowing easy identification of the stores with the best performing departments or categories within the chain. PivotalView has been deployed in independent grocery chains up and down the West Coast for nearly 3 years and has proven that Empowered Merchants, using PivotalView, deliver outstanding results. Here are a few examples: Deli Manager: Carol is the Deli manager for a store in a multi-store chain. While she quickly acknowledges that she’s not a “technology person”, she has embraced PivotalView quickly and uses it with great impact. Carol’s results (for the last year):

Carol’s Quote: “I'm competitive and this tool makes me even more competitive.” Carol’s PivotalView Usage Profile: Carol is a daily user, always before arriving at the store. She aggressively uses PivotalView to monitor top selling items and track the performance of new items. She also compares the performance of items in her department to other deli departments in the chain to leverage best practices and identify store voids. The Wine Steward:Joel is a first time wine steward for a single store Independent Grocer. Joel’s results (for the last year):

Joel’s Quote: “I am obsessed with Pivotal Tools. I look at it in the early morning hours. I like seeing my daily, weekly, monthly sales. If sales are in the red, it motivates me to do more selling and merchandising.” Joel’s PivotalView Usage Profile: Daily usage, often including days off, always before arriving at the store, also used throughout the day in the store. Joel recently integrated a category structure which, when used with PivotalView, provides more effective visibility for assortment and promotion monitoring. The Grocery Manager: Larry is the Grocery Manager at a single store that is part of an Independent Grocery chain. Larry’s results:

Larry’s PivotalView Usage Profile: Larry is a daily user, always before arriving at the store. He uses PivotalView to aggressively pursue assortment optimization, through tracking top items and slow moving items. He performs extensive comparison to other stores in the chain to feed his competitive spirit and ensure that he’s the top performer in the chain. Technology developments in cloud based computing, analytics techniques and smartphones now make it possible to provideteam members of Independent Grocers easy access to highly relevant information, including at the item level, right on their smartphone. Deployment of tools like PivotalView unlock the competitive nature of grocers, resulting in better performance, without additional investments in supervisory personnel, merchandisers, reports, or audits. Actionable Insights available all the time through mobile devices, means merchants, such as department or store managers, spend more time in their departments with customers and less time in the office running reports; leading to higher levels of ownership and accountability. For store managers and executives, PivotalView allows them to stay in touch with their stores, wherever they are, and engage with their teams, either celebrating victories or problem-solving challenges. Using mobile devices coupled with cloud based analytics and automation virtually eliminates the support burden on IT personnel or POS coordinators, while delivering a huge cost advantage to owners. In summary, there’s never been a better time for Independent Grocers to leverage new business intelligence tools, like PivotalView from Pivotal Tools, to empower their teams to drive more shopper trips and sales in an increasingly competitive market. |